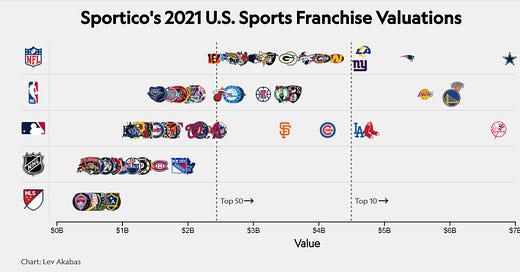

The Average NBA Team Is Now Worth $2.6 Billion

The Email is Sponsored By….

I love coffee, and I used to make it at home or pick it up at the coffee shop. But here’s the problem — it either wasn’t very good, involved a big clean-up, or ended up being extremely expensive.

So, this is where Cometeer comes in — the best coffee I’ve ever had. In partnership with MIT chemists and award-winning scientists, C…