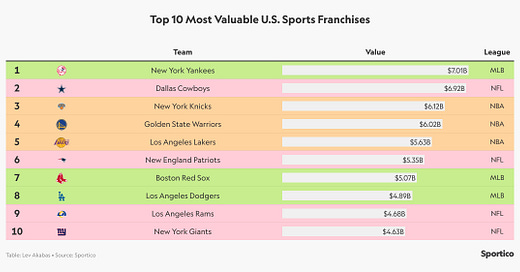

The Most Valuable Sports Franchises In The United States

Huddle Up is a daily letter that breaks down the business and money behind sports.

Join more than 55,000 professional athletes, business executives, and casual sports fans that receive it directly in their inbox each morning — it’s free.